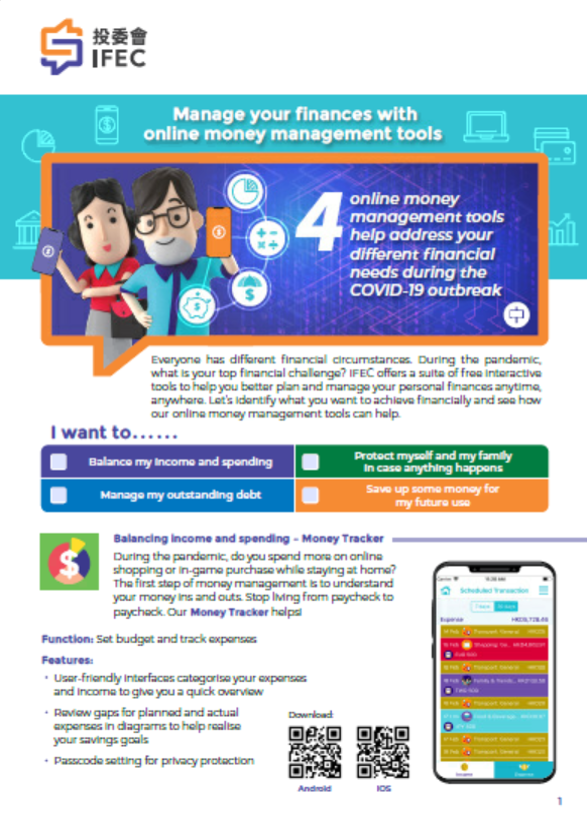

Manage Your Finances Money Management Toolkit

Everyone has different financial circumstances. During the pandemic, what is your top financial challenge? IFEC offers a suite of free interactive tools to help you better plan and manage your personal finances anytime, anywhere. Let’s identify what you want to achieve financially and see how our online money management tools can help.

I want to…

|

▢ 1. Balance my income and spending |

▢ 3. Protect myself and my family in case |

|

▢ 2. Manage my outstanding debt |

▢ 4. Save up some money for my future |

1. Balancing income and spending – Money Tracker

During the pandemic, do you spend more on online shopping or in-game purchase while staying at home? The first step of money management is to understand your money ins and outs. Stop living from paycheck to paycheck. Our Money Tracker helps!

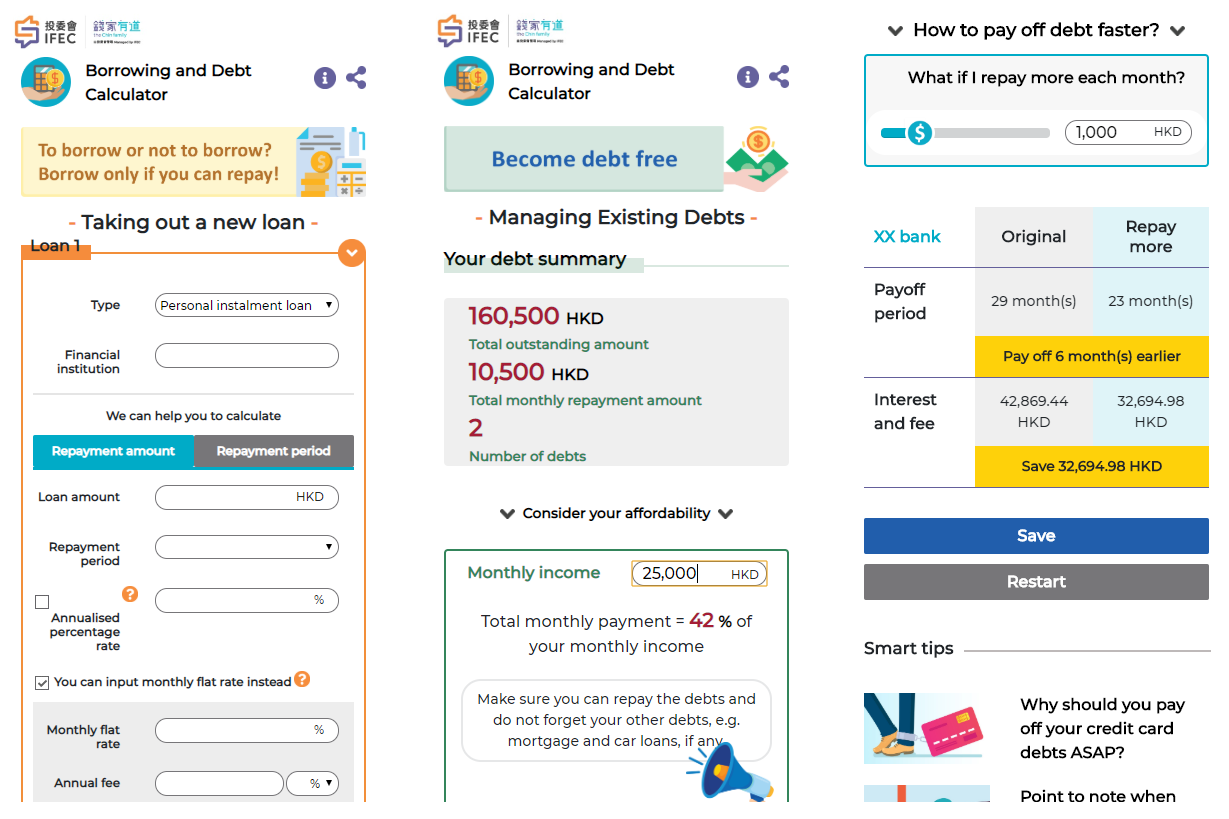

2. Managing debt - Borrowing and Debt Calculator

The pandemic affects all walks of life. Some people may have borrowed money to make ends meet due to reduced income. If you need to take out a new loan or manage existing debt, our Borrowing and Debt Calculator helps! Don’t forget to borrow only if you can repay!

![]()

Function: Calculate repayment details and provide tips to manage debt

Features:

- Cover 4 types of common loan products

- Work out the repayment amount, period, borrowing cost and help assess the loan's affordability

- Provide practical tips on borrowing and debt management

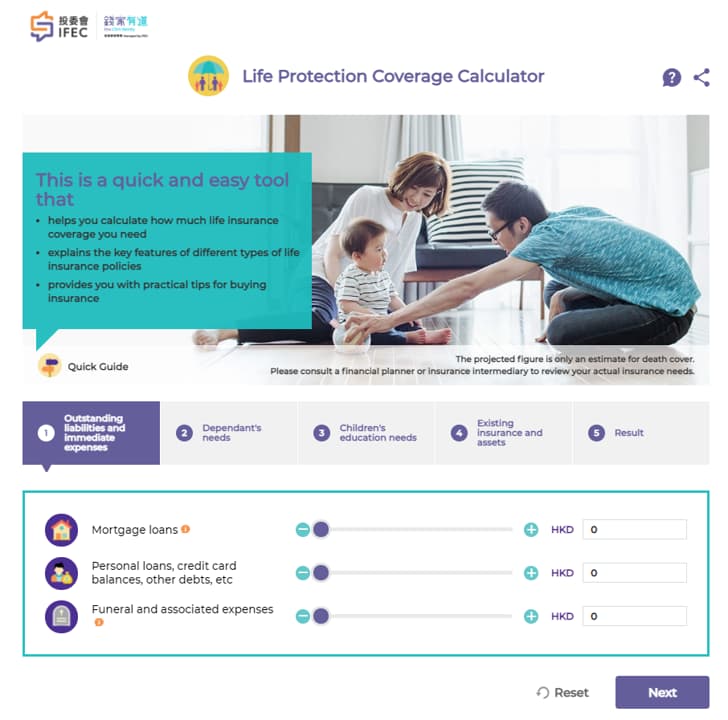

3. Protect myself and my family - Life Protection

Coverage Calculator

During the pandemic, people realise how fragile life can be. Life insurance covers the financial needs of your family in the event of a death. However, do you know how much protection you need? Our Life Protection Coverage Calculator helps!

![]()

Function: Calculate your required life insurance coverage

Features:

- Work out how much life insurance coverage you need in 5 simple steps

- Compare the key features of different types of life insurance policies

- Provide practical tips for buying insurance

4. Save for my future - Savings Goal Calculator

Everyone wishes to save up for different financial goals, be it preparing an emergency fund to setting up a home. Our Savings Goal Calculator can help you systematically plan ahead and achieve your goal!

![]()

Function: Calculate how your savings goals can be achieved

Features:

- Work out how much you need to save regularly or how long it will take to achieve the savings goal

- Work out the total amount saved with a fixed amount of money saved regularly