Saving for the future

Setting financial goals, whether large or small, short- or long-term, can be motivating and give you something to aim for. Your goals may change at different stages in your life. Whatever your age or circumstances, it's good practice to work out your goals and start saving as early as you can.

Start saving early

Saving early can really pay off due to the power of compound interest. When you save or invest in something that pays interest, you earn interest on your principal (the original investment amount). If you continue to save and earn interest, you will receive interest on the principal plus the interest you earned last time – earning interest on your interest. This is called compound interest and it can significantly boost your savings over time.

Saving early to let your money grow

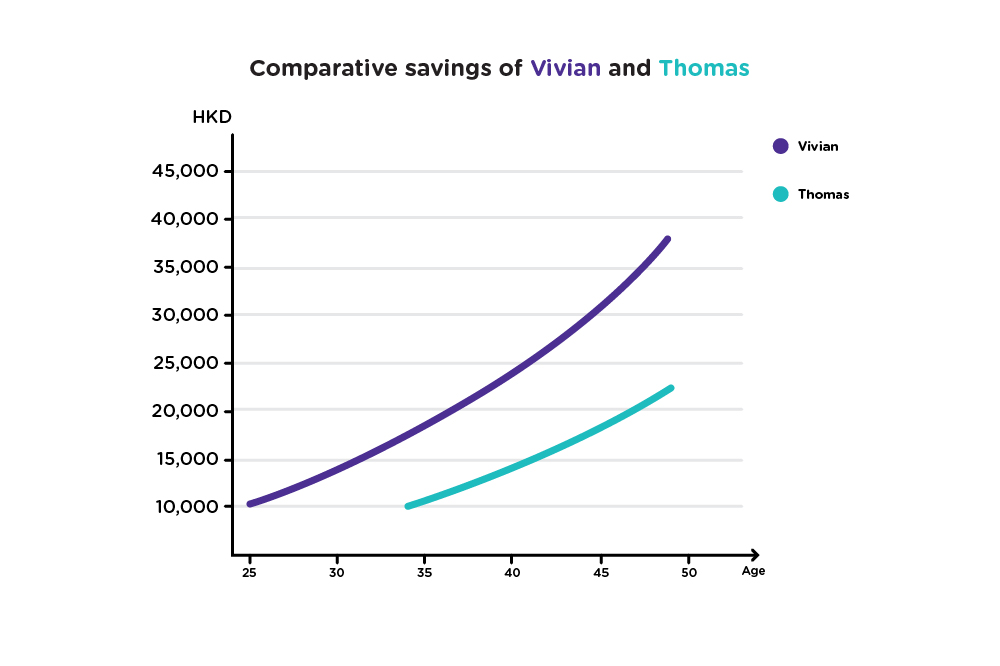

Vivian and Thomas are both 25 years old. Vivian invests HKD10,000 at an annual compound interest rate of 5.5%. When she turns 50, her investment will have grown to HKD38,134. Thomas waits until he is 35 to invest HKD10,000 at the same interest rate. By the time he reaches age 50, his investment will be worth HKD22,325.

Even though they both invested the same amount, Vivian gave her money more time to grow. She earned a total of HKD28,134 in interest, while Thomas earned only HKD12,325.

The sooner you start saving, the sooner you start benefitting from the power of compound interest – which puts time to work on your savings. The more time you allow for your savings to grow, the greater the effect of compound interest – which is why it's a good idea to start saving early on.

Save for emergency

No one thinks that they really need to take a step back when everything is good. Save an emergency fund of three to six months of living expenses to deal with any unexpected crisis.

Make it easier to save

You may find it easier to save if you keep a separate savings account from your regular transaction account. Consider transferring a fixed amount of money from the account you receive your regular income at the beginning of each month and put it into the separate savings account. You can also consider joining a savings plan offered by banks that automatically deduct contributions from your account each month.

And it may be helpful to break your larger savings goals such as buying a house and planning for retirement into some smaller goals such as paying for education or going on vacation to help you get there. Set yourself some clear and realistic savings goals – you will find it easier to save money when you know why you are saving. Also, start with immediate savings goals, such as paying off your credit cards or getting out of debt . Saving for an emergency fund should also be a priority.

Promise yourself some little self-rewards for achieving each small goal and tell yourself along the way that every dollar you save is bringing you closer to something that's important to you.

Where to save

In general, you should consider putting your emergency fund and short-term savings in safe investments that earn interest, such as a bank savings account or term deposit. This will give better peace of mind that capital will be available any time you need it. As a depositor, be it personal or corporate, you are entitled to be compensated up to a maximum of HKD500,000 according to the Deposit Protection Scheme (with effect from 1 October 2024, the protection limit will be increased to HK$800,000). The Scheme was introduced to pay depositors compensation in the event of the failure of a bank which is a member of the Scheme. Learn more about the Scheme.

Long-term savings should generally include investments that offer higher returns such as stocks or funds. These can grow your savings faster, but there is also a higher risk you may lose money and you need to do a thorough risk assessment to determine the kind of investment instruments that suit your needs.

Saving towards your goals

What are your financial goals? Going on vacation, buying a house, getting married? Whatever your goals are, it pays to have a plan in place to reach there.

Start with some short-term and immediate saving goals, such as paying off your credit cards or getting out of debt . Saving for an emergency fund should also be a priority.

Use our savings goal calculator to check how you can achieve your goals. It will help you work out how much you need to save each week, month and year in order to reach a savings goal, or if you plan to save a certain amount how long it will take for you to achieve your savings target.

Money-saving tips

Here are some tips helping you to save money and budget better:

- Avoid impulse buys. Stick to the items on your shopping list when you visit a store.

- Delay purchases. Found something "Have" to buy? Wait for a day or two before deciding, you may not need it after all.

- Start a spending diary. If you keep a record of every dollar you spend, you'll know exactly where your money is going, and be more conscious of your spending habits.

- Substitute. If the item you want doesn't fit your budget, consider buying a similar, but less expensive item.

- Compare. Shop around to compare prices at different retail outlets, online and offline, you may find the same item or service for a lower price.

- Set rules. Think about the limited storage space at home and set some rules for shopping. For example, set a limit for birthday and festive presents or consider produce some homemade gifts.

- Reduce. Review everyday expenses to cut back on non-essential items.