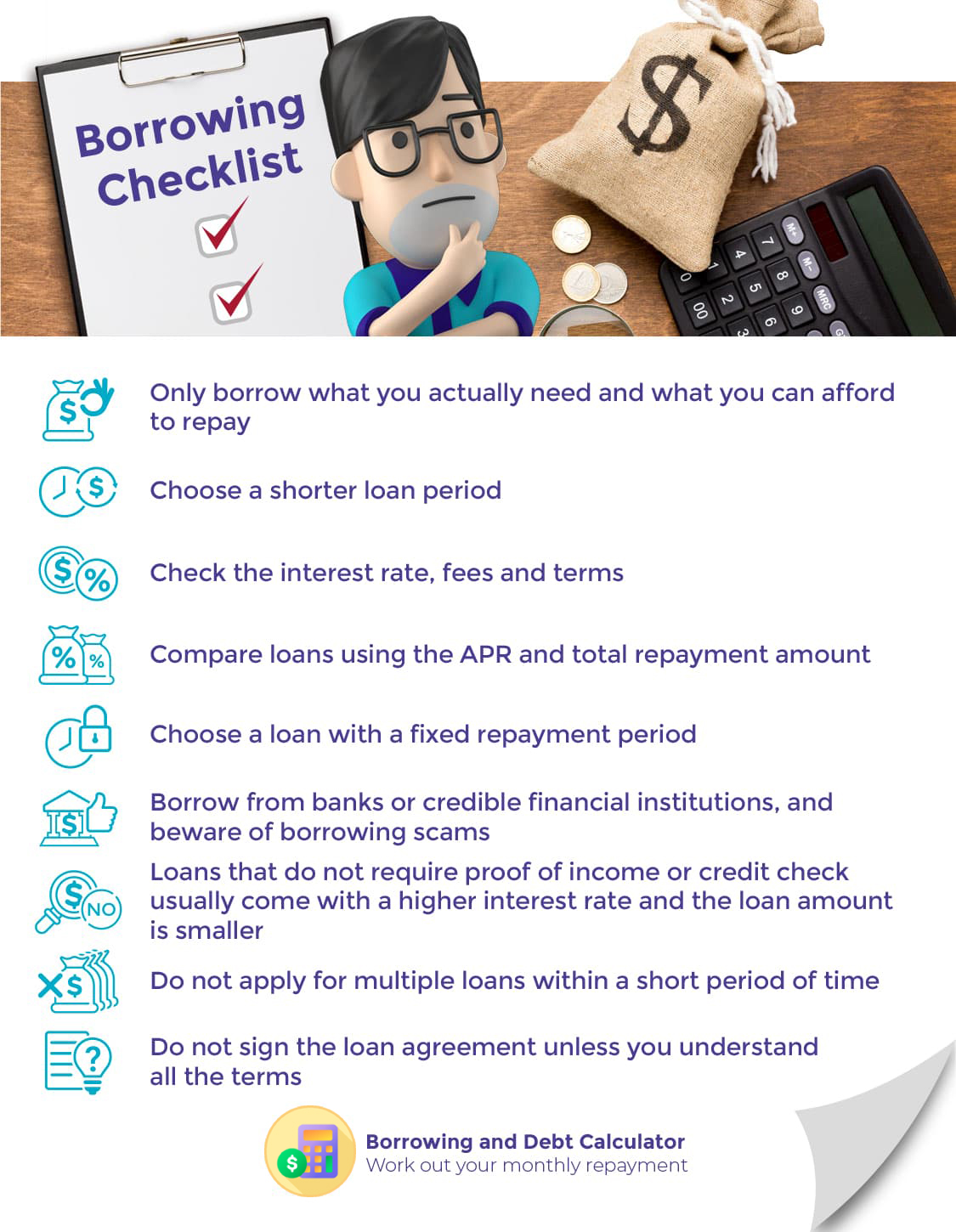

Go through the borrowing checklist before taking out a loan

Even if you have a genuine need to borrow, do so with care. Consider the sum that you really need to borrow, the loan period, the lender and choose the loan product wisely.

1. How much should I borrow?

Rule 1: Only borrow what you actually need.

Rule 2: Only borrow what you can afford to repay.

Use the Borrowing and Debt Calculator to work out the monthly repayment amount to see if you can afford to repay.

2. How do I choose a loan period?

The longer the loan term, the more the interest you will need to pay. Therefore, choose a shorter loan period as long as the monthly repayment is manageable to save on interest. If possible, try not to choose a term that is longer than two years so the loan won’t have a long-term impact on your personal finances.

3. How much interest and fees do I have to pay?

The interest rates you see on the websites of lending institutions are for reference only. The actual interest rate applicable to you depends on your loan amount, term, financial circumstances and credit score. Consumers can check with the lending institution regarding the applicable interest rate, fees, the Annualised Percentage Rate (APR), the total repayment amount and any other terms and conditions of the loan.

4. How do I compare loan products?

Do not only look at the lowest interest rates quoted in advertisements or comparison platforms. This is because the lowest rate shown is generally only applicable to large sums and for selected clients.

Banks usually charge interest and fees when they offer a loan. You can ask your bank about the APR. An APR is a reference rate which includes the interest and other fees of a loan and it helps consumers compare the borrowing costs of different loan products. On the other hand, loans offered by finance companies do not involve handling fees, but this does not mean that the cost of borrowing is lower. Certain finance companies may charge a very high interest rate (the highest legal lending rate is 48%). Note that banks and finance companies may use different ways to calculate the annual interest rate. Therefore, you should compare both the APR and the total repayment amount. Learn more

5. Should I choose a fixed-term loan or a revolving loan?

There are different loan products on the market. In terms of how repayment is made, there are two main categories:

(1) Loans with a fixed repayment period, e.g. personal instalment loan, credit card cash instalment loans.

(2) Loans without a fixed repayment period, e.g. revolving loan, credit card balance, credit card cash advance.

Generally, loans without a fixed repayment period are more flexible. The borrower can decide how much to repay every month (subject to a minimum payment amount). However, that can also easily turn into a loan that sees no end. Unless you are confident to have the loan paid up within a short period of time, it is better to choose a loan with a fixed repayment period, which allows you to repay according to a clearly defined goal and plan ahead for personal finance.

6. What do I need to be aware of with debt consolidation loans?

If you have accumulated a large amount of credit card debts, you may consider replacing it with a debt consolidation loan which charges a lower interest rate. This can help you save on interest and settle your debt earlier. However, it is important that you keep any excessive spending habits in check to make sure you do not continue to accumulate credit card debts. Also you should take time to compare different debt consolidation loans as they are offered at different interest rates.

Furthermore, if you intend to replace personal loans that charge higher interest rates with a debt consolidation loan, be sure to check if there is an early repayment penalty for your other instalment loans if you settle them before maturity. In general, the later you pay off the outstanding balance of an instalment loan, the less you can save on interest. In some cases, early repayment fee could mean paying more than your savings in interest. Consumers who intend to pay off an instalment loan before maturity should first approach the lending institution to check the unpaid principal amount, the early repayment fee and the amount of interest that could be saved. They should consider if the cost will outweigh the benefit. Learn more.

7. How do I choose a lending institution?

The internet and social media are flooded with loan ads. Consumers should choose very carefully. They should check the lending institution and choose a bank or a credible finance company. In addition, they should also be aware of fraud. Some common lies used by fraudsters include: a stranger calls and claims to be a staff member of a bank or a financial consultant, offering to help you to secure a loan, and claiming that there is no charge unless your loan application is successful. Just remember this advice: "You have to repay your loans. Don't pay any intermediaries". Learn more

8. Some lending institutions claim that they offer loans that require no proof of income or "TU-free loans" / "Credit report-free loans". What should I be aware of?

Your ID card, proof of address and proof of income, etc., are often required when you apply for a loan. Lending institutions will also check a borrower's credit report with credit reference agencies. While some lending institutions offer products that do not require proof of income or credit check (so called "TU-free loans" / "Credit report-free loans"), these products often come with higher interest rates and smaller loan amounts. Consumers should take note of the rate of interest and consider whether there are other alternatives.

9. Can I apply for a number of loans in one go?

Consumers should not apply for multiple loans at the same time or within a short window of time. When a lending institution assesses and authorises a loan, it usually checks your credit record with credit reference agencies. If your credit report shows many credit application enquiries within a short time, the lending institution concerned may be suspicious about your financial circumstances and your ability to repay; they may even reject your loan application.

Learn more: Working out a repayment plan

23 Jun 2020