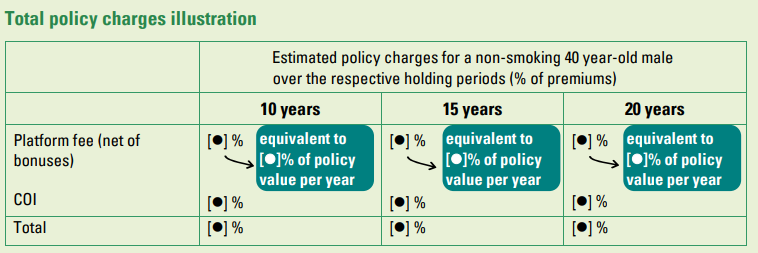

Total policy charges illustration of ILAS products

To provide a full picture of the fees and charges at the policy level, insurance companies are required to use a scenario of an insured being a non-smoking 40 year-old male to illustrate the total policy charges he pays over holding periods of 10, 15 and 20 years for each premium payment term available under the ILAS policy. It is an important disclosure which is required to be disclosed upfront in the fees and charges section of the KFS.

The total policy charges illustrate here include platform fee (net of bonuses) and cost of insurance protection (COI), but do not include charges on early surrender and partial withdrawal, and are expressed as a percentage of the premium paid over the respective holding periods.

Also, the estimated total platform fee (net of bonuses) figures over the respective holding periods are translated to a single all-in annual fee charged as a percentage of policy value per year, so that you will be able to know how much you are paying on average per year for such holding period.

The computation of total policy charges figures is based on the following assumptions:

|

You should not take the total policy charges figures at their face values. Your individual circumstances may be different from the circumstances assumed for the purpose of computing the total policy charges figures of any particular ILAS policy that you are considering. Therefore, the actual percentage applicable to you as a policyholder may differ from the total policy charges figures specified in the KFS of that ILAS and may be significantly higher if, for example, the premium amount is lower, the sum insured is higher and/or the underlying investments of the policy concerned are making losses.

It is in your best interest to know how the total policy charges figures may help you make comparison across different ILAS products. This way, you can choose the suitable one if you decide to invest in ILAS products as part of your overall financial planning, after considering carefully the product features and related risks. To learn more about the total policy charges figures calculation, you should consult your intermediary or check with the product issuer via the intermediary.

Know more about the total policy charges

Single premium vs. regular premium

ILAS policies may offer multiple premium payment options for policyholders to choose from. The premium options include single premium which is usually paid one-off at the beginning of the policy term and regular premium which is paid on a regular basis over the premium payment period. Different premium options provide different bases for the computation of the total policy charges figures. The fee charging structure and the policy charges applicable to different premium options may also be different. Therefore, you should only compare the total policy charges figures of different ILAS products with the same premium payment option, i.e. single or regular.

You may find that in the KFS of an ILAS product, if an ILAS product has multiple premium options, then the total policy charges figures that are applicable for different premium options are set out separately.