An Investment-Linked Assurance Scheme (ILAS) is a long term investment-cum-life insurance product. The premium payment period may be up to 20 years or even longer. Generally speaking, ILAS products are designed for investors who are prepared to hold the investment for a long term period and willing to pay surrender charges which maybe high if the policy is surrendered in early years.

Refer to the KFS for the expected minimum holding period

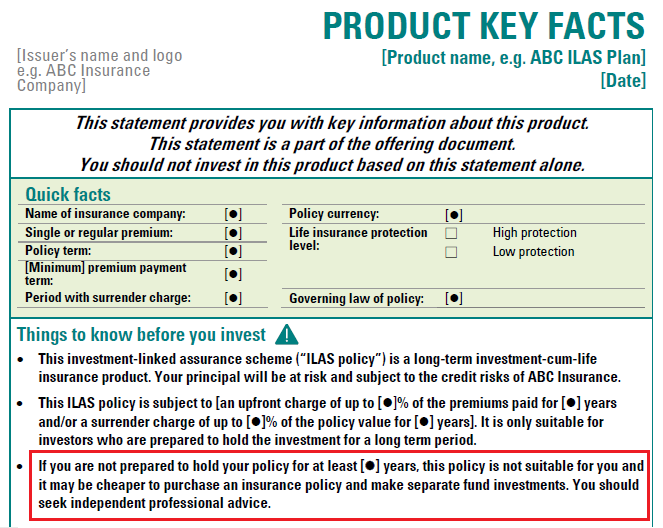

Investors should refer to the “Things to know before you invest” section of the Product Key Facts Statement (KFS) where the insurance company indicates the expected minimum holding period of the ILAS policy (which is calculated based on a set of standard assumptions).

You can find the expected minimum holding period on the first page of the KFS.

In general, ILAS products with low or minimal insurance protection tend to be more liquid than ILAS products with high insurance protection. And thus, low protection ILAS products may have a shorter expected minimum holding period (e.g. 5 years) and high protection ILAS products may have a longer one, say 10 years.

When determining the expected minimum holding period, insurance companies will base on a set of standard assumptions and consider, amongst others, the level of insurance protection and other benefits, premium payment term and the level and period of surrender charge. Insurance companies will also make reference to the fee assessment against comparable alternative products. Investors should note that the expected minimum holding period listed on the KFS is for reference only. The actual period applicable to you may be different depending on your own circumstances (e.g. your age, premium payment amount and period, sum insured amount).

Think carefully whether the expected minimum holding period aligns with your investment horizon

Investors should consider whether the expected minimum holding period aligns with their investment horizons. If you are not prepared to hold the ILAS policy longer than the expected minimum holding period, it may not be suitable to you. Also, whether you can afford the premiums for the entire premium payment term. If you are not prepared to pay premiums for the entire premium payment term, you may choose a shorter premium payment term or even a single premium product. You should consider if there are other comparable alternative products that may better suit your needs, for example, it may be cheaper to buy a term life insurance policy and invest in funds via an asset-based fund platform separately. Seek professional advice if necessary.