My first credit card

At the start of each academic year, it is not surprising to see banks actively promote their credit cards to freshmen. As the application process is rather simple - with no proof of income needed - and tempting welcome gifts are offered, many students cannot resist the temptation and apply for these cards.

Credit cards make spending money very easy, with no need to carry around large amounts of cash every day. Credit cards, however, can also make you spend money you don't have, and you could end up with big debts early in your university life.

Buying with credit cards is easy, but paying back debts is hard, especially for students with little income. If you don't repay credit card debts on time while you are at college, your credit record may be ruined, making it hard to apply for jobs or seek a promotion. In many jobs that involve handling money or working in an official role - such as the police or armed forces, as well as the financial or legal sectors - personal credit records can be checked before you are offered employment.

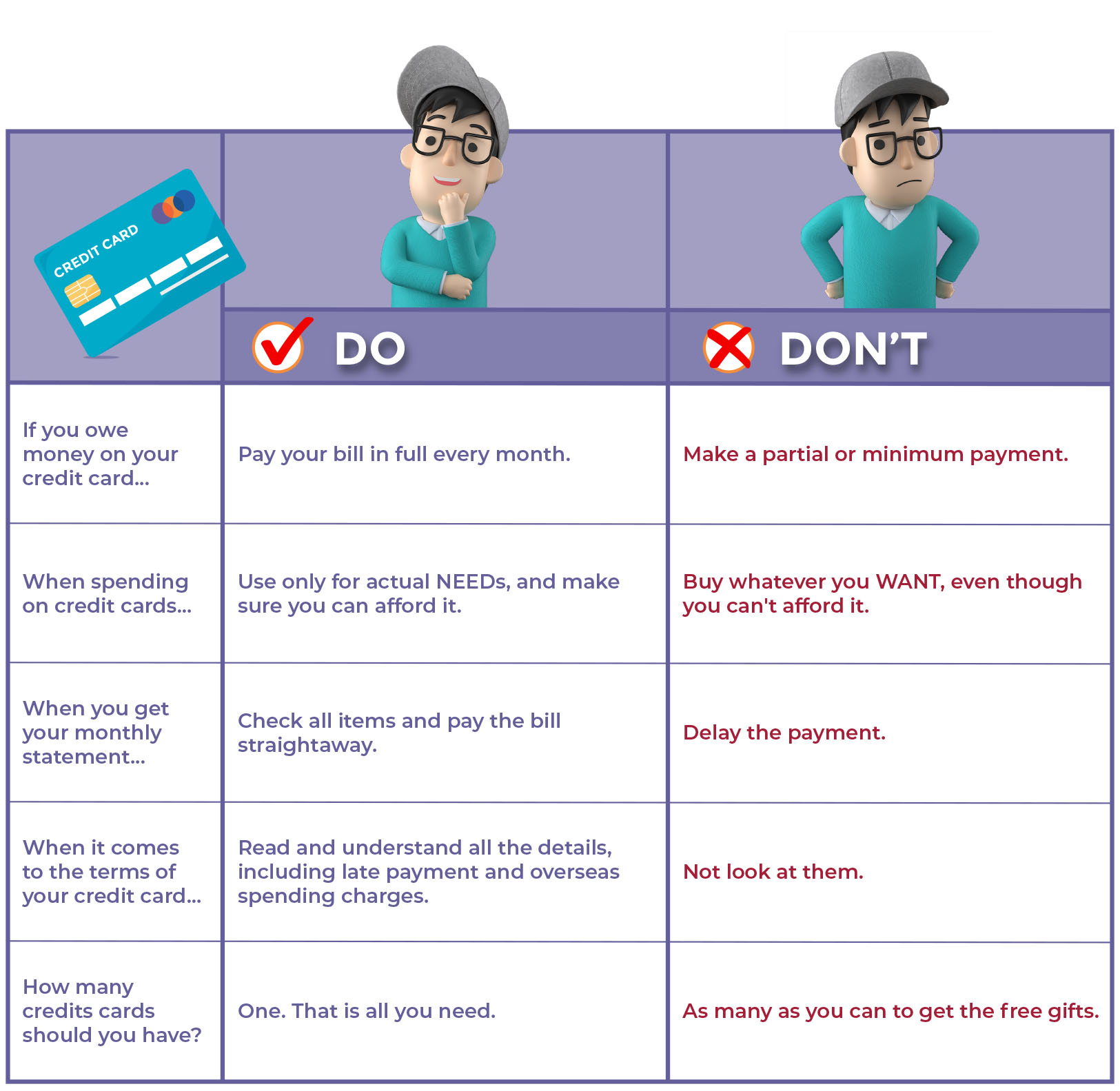

Credit card dos and don'ts

Understanding the interest payable on credit card debt

- How high is the interest of credit card payments?

Annual interest rates on the money owed on credit cards can be more than 30%. You may have to make huge interest payments if you do not pay your credit card bill in full every month. You will also be immediately charged interest on anything else you spend, such as monthly insurance payments or any new purchases. - Is it okay just to make the minimum payment (Min Pay)?

While some people think Min Pay makes managing money easier, the opposite is true. Min Pay will always leave you owing more money. If the annual interest rate on your credit cards is 35% and you owe $20,000 then, with Min Pay, it will take you 26 years to pay off the debt - even if you don't spend any more money on the card or have to pay any annual charges or extra fees. In total, the interest payment will be $47,536 - 2.35 times the amount you originally owed! - What should you do if you already owe money on your credit card?

If the debt is small, you should spend less over the next few months and try to repay the money as soon as possible. If you owe a large amount, you may consider the following:

- Use The Debt Calculator to find out just how much you owe.

- STOP using your credit cards until everything is repaid.

- Seek help from family, friends or social workers for professional advice:

- Caritas Family Crisis Support Centre

Debt and Financial Capability Project

Debt hotline: (852) 3161 2929

Website: http://fcsc.caritas.org.hk/ - Tung Wah Group of Hospitals Healthy Budgeting Family Debt Counselling Centre

Telephone: (852) 2548 0803

Website: https://fdcc.tungwahcsd.org/en/home-en/

- Caritas Family Crisis Support Centre