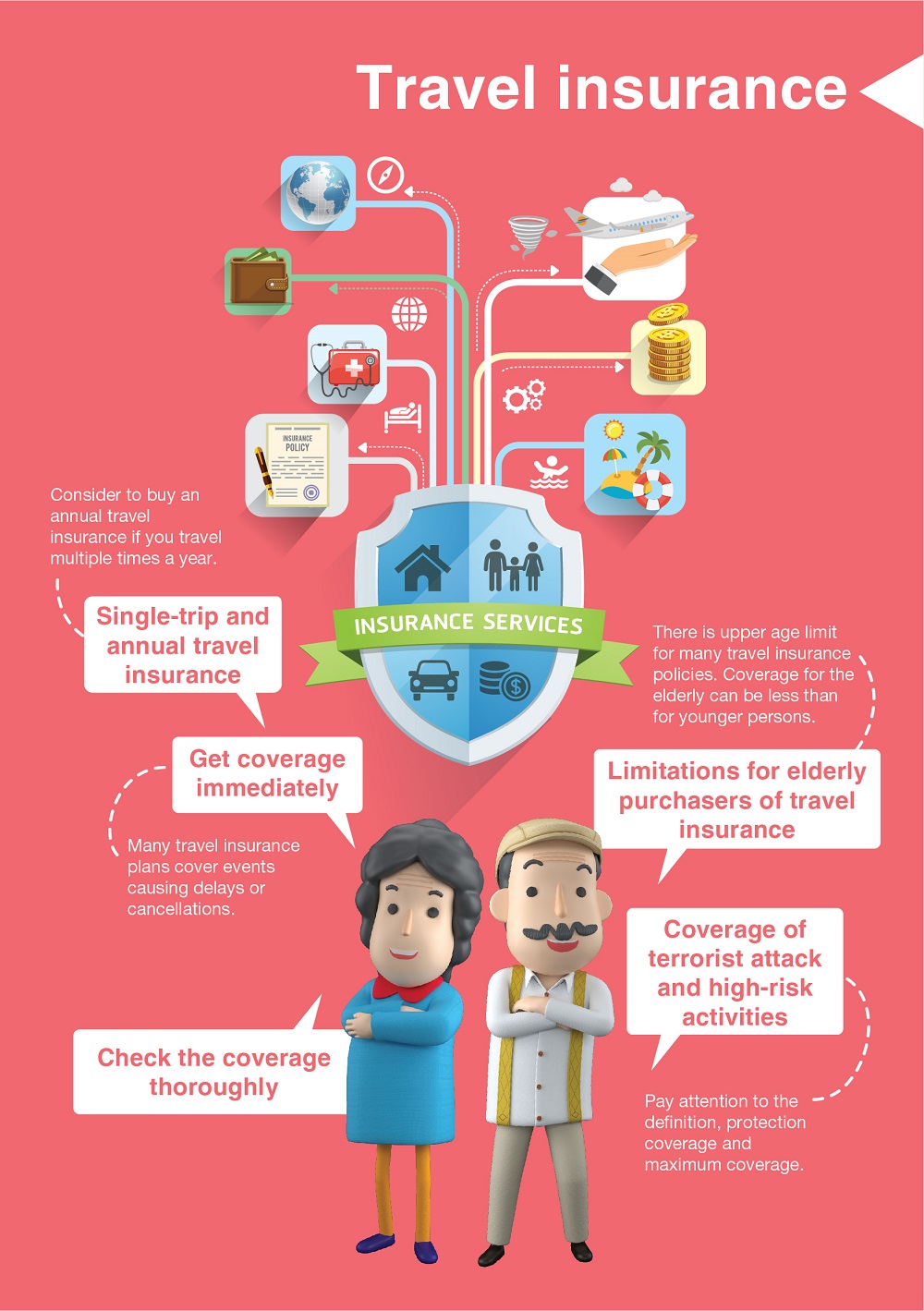

Travel insurance

With more free time, retirees may find themselves traveling more often. Taking out the appropriate travel insurance can offer some peace of mind.

Get coverage immediately

Many travel insurance plans cover events causing delays or cancellations, e.g. weather issues or if you become too ill to travel. Therefore, it is a good idea to purchase insurance soon after booking your transportation and accommodations.

Limitations for elderly purchasers of travel insurance

The upper age limit for many travel insurance policies ranges from 70-85 years. Coverage for the elderly can be less than for younger persons, e.g. the upper limit of death benefit and benefits on medical expenses.

Check the coverage thoroughly

Pay attention to the maximum benefit for medical expenses (emergency evacuation and repatriation services, hospital deposit and treatment expenses after returning to Hong Kong), and note the exclusions and conditions, e.g. age limit on protection of participation in high-risk sports and activities.

Single-trip and annual travel insurance

When purchasing an annual travel insurance plan, take note that the insured period for most annual travel insurance policies is only 60– 90 days, and the maximum benefit for certain items in the annual travel insurance plan may not be higher than that of a single-trip travel insurance plan.

Coverage of terrorist attack and high-risk activities

Pay attention to the definition, protection coverage and maximum coverage. Most travel insurance policies will not cover loss caused by war or nuclear risks.

24 April 2019