Target date funds

A target date fund is typically designed to be a long-term investment for individuals with a particular “target date” in mind, such as a retirement date. The name of the fund usually includes a date that represents the “target year”, for example, the year that investors target to withdraw their investments or intend to retire.

As investors, you may need to note however that even if target date funds share the same target date, they may have very different investment strategies and risks. These funds may not guarantee that you will have sufficient retirement income at the target date, and you may face the risk of losing money.

How a target date fund works?

A target date fund generally holds a diversified portfolio of assets, including stocks, bonds, and cash and cash equivalents (such as money market instruments), which is rebalanced among asset classes over time.

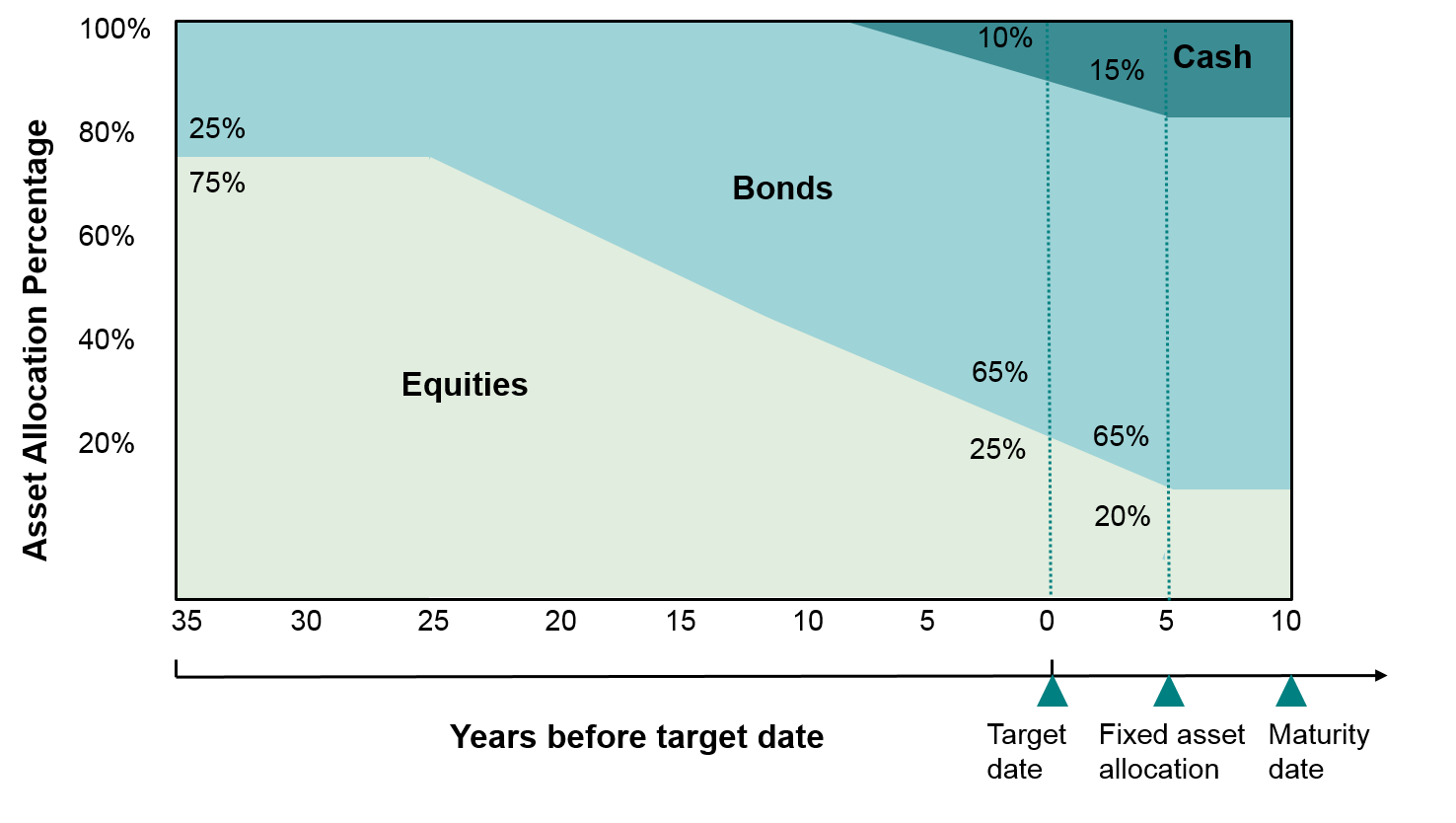

As the target date approaches, a target date fund would typically shift its asset allocation in a manner that is intended to become more conservative – usually by decreasing the percentage allocated to stocks and increasing the percentage allocated to bonds, and cash and cash equivalents. The asset allocation of a target date fund would eventually become fixed at its most conservative mix at a certain date, which may or may not be at the target date.

Also, a target date fund may or may not be automatically terminated at the target date, and in the latter case, it will continue to be managed in accordance with the investment objectives and policies of the fund after the target date as stated in the offering documents of the target date fund.

Illustrative example of how the asset allocation of a target date fund may shift

The above example shows that the asset allocation is not fixed at the target date but at a later date. The asset allocation among equities, bonds and cash can be seen for the whole duration of the fund, including the percentages allocated to the various asset classes at the date when the asset allocation will be fixed. The maturity date of the fund is the date which has been set for the fund to be terminated in the future, and in this example is 10 years from the target date.

Key risks

-

Investment risk

The ability of the fund to meet its investment objective is directly related to its target asset allocation which is based on its target year. If the asset allocation strategy does not work as intended, the fund may not achieve its objectives, and investors may suffer loss prior to, at, or after the target date.

-

Risks associated with underlying assets

The investments of target date funds in the underlying assets are subject to the typical investment risks that correspond to such asset classes. For example, the fund’s investment in equities may be subject to market volatility and risk of suspension of exchanges; and the fund’s investment in bonds may be subject to counterparty and credit risk, credit rating downgrading risk, liquidity risk and interest rate risk.

These specific risks should be set out in the offering documents of the fund. Investors should refer to and read the specific risks relating to the fund’s investments in the offering documents before investing.

Points to note before investing

-

Know yourself

As investors, you need to carefully consider whether a certain target date fits your personal circumstances. Review financial conditions and risk tolerance level before making your investment decision and from time to time thereafter.

-

Know your investments

Detailed information about the investment strategies and risks of a target date fund can be found in the offering documents of the fund.

Target date funds with the same target date may have very different investment strategies and levels of risk, and such variations may occur prior to, at, or after the target date. As a result, target date funds with the same target date may have different investment results.

Before investing, you should consider the fund’s asset allocation over the whole life of the target date fund and at its most conservative investment mix, as well as the fund’s risk level.

You should note that even within the same type of underlying assets such as equities, some equities may be riskier than other equities. Although bonds are generally perceived to be less risky than equities, some types of bonds may even be riskier than equities. Investments in some types of bonds at the most conservative mix of a target date fund may thus not be as safe or conservative as perceived and you may face the risk of losing money.

-

No guarantee

Investing in target date funds does not guarantee repayment of principal to investors at or after the target date nor sufficient retirement income to investors at the target date. Therefore investors may face the risk of losing money.

-

Fees

Target date funds with the same target date may also charge different fees. Where a target date fund invests in other funds, fees may be charged by the target date fund as well as the underlying funds into which the target date fund invests.

-

Asset allocation at target date

Investors should understand when a target date fund will reach its most conservative investment mix, and whether that will occur at or after the target date. Sometimes such date is different from the target date.

Further, in some instances the fund will not be automatically terminated at the target date but will continue to be managed in accordance with the investment objectives and policies disclosed in the offering documents of the fund.

Investors should consider whether the fund’s investment mix at or after the target date fits their plans for the future, such as whether they intend to withdraw the proceeds at the target date, or to continue to invest in the fund after the target date.

-

Changes in asset allocation

As investors, you should also pay attention to whether the intended asset allocation may be subject to change at the discretion of the fund manager without the need to obtain your prior approval. Such change may bring additional risks.

You can refer to the fund’s annual report for the actual asset allocation of the fund and pay attention to any notices the fund manager may issue.

-

Termination of a target date fund

When a date has been set for the fund to be terminated (the “maturity date”), investors should take note of details of any switching out option available to investors prior to or at the maturity date, and actions that will be taken by the management company and/or the trustee at the maturity date. Such information can be found in the fund’s offering documents.

Further information on a target date fund’s asset allocation

-

Indicative asset allocation

For details of the asset allocation, you can refer to the asset allocation chart, graph and/or table in the offering documents that shows the intended asset allocation in percentage terms over the entire duration of the fund at identified periodic intervals that are no longer than five years in duration.

The chart, graph and/or table of the fund should also show the asset allocation at the launch, the target date, the date when the asset allocation becomes fixed (which may be different from the target date) and, where applicable, the maturity date.

Investors should note however that the asset allocation shown in the chart, graph and/or table would usually be indicative only and the actual asset allocation of the target date fund may be different.

-

Actual asset allocation

The actual asset allocation of a target date fund can generally be found in the fund’s annual report.