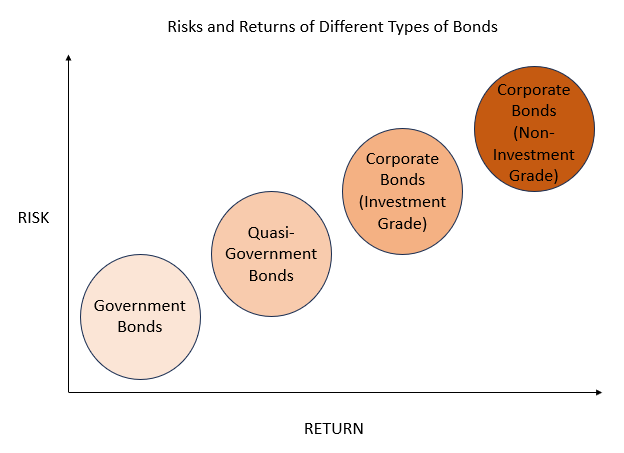

Compared with stocks, many investors may not be familiar with bonds and may often perceive bonds as a less risky income product. This is a reasonable assumption because bonds typically offer a fixed income with lower volatility compared to assets with higher potential upside, such as stocks. However, this is just a general comparison. The truth is that the risks associated with different types of bonds may vary significantly and some bonds may be of high risk. Learn more: What are bonds?

Credit ratings reveal default risk

If you invest in bonds, you are actually lending money to the bond issuers, which can be companies or governments. If the issuers struggle financially, they may fail to pay the interest or principal as promised. If they become insolvent, investors may even lose all their money invested. Therefore, investors need to carefully consider the default or credit risks before investing in bonds. For example, most government bonds are usually considered lower risk investments because of the relatively lower chance of default. Whereas certain corporate bonds may carry higher risks.

Investors may assess the creditability or solvency of the issuers/bonds based on their credit ratings. Credit ratings are assigned by credit rating agencies such as Moody’s, Standard & Poor’s (S&P) and Fitch. They are classified as two main categories: investment grade and non-investment grade.

| Grade | Credit ratings | Description |

|---|---|---|

| Investment grade | Moody’s: Aaa to Baa3 S&P and Fitch: AAA to BBB- |

High to lower-medium quality grades |

| Non-investment grade (or speculative grade) |

Moody’s: Lower than Baa3 S&P and Fitch: Lower than BBB- |

Speculative to default |

High interest bonds may involve higher credit risk

The credit rating agencies will assign higher rating to the bonds which, in their opinion, the bondholder may have a better chance of receiving a payment for the principal and interest of the bond. On the contrary, the lower credit ratings reveal higher default or credit risk. Bonds with credit rating lower than Baa3 (Moody’s) or BBB- (S&P and Fitch) are classified as non-investment-grade bonds that have a greater chance of default, so they are also known as junk bonds. Since these bonds typically offer higher returns to compensate for the higher risks, they are also called high-yield bonds. Investors should note that credit rating is only an opinion of the particular credit rating agency rather than a credit guarantee for the bond or issuer, and the credit ratings may change from time to time. Besides, not all bonds have credit ratings.

There is no such thing as a free lunch. An investment product with attractive expected return often has higher risks, and bonds are no exception. Investors should never seek high returns blindly or assume that all bonds are less risky. It is always important to do your own research before investing to fully understand the features and risks of the investment products, and carefully consider your risk tolerance. Learn more: Key risks of bond investment

31 July 2024