Before making investment decisions, especially one involves complex and derivative products, I always ask myself if I can fully understand the features and risks.

Derivatives are known for their complexity and high risks. Some financial products have embedded derivatives, such as accumulators and decumulators, nicknamed “I kill you later” and “they kill you later”, which contain options as a derivative. If you are not familiar with the features and risks of options, it is best not to make rush investment decisions on accumulators and decumulators.

If you have traded options, you would know that it is a financial contract which stipulates that within a specified period of time, the option buyer has the right to buy or sell the underlying asset from or to the option seller at a preset price (strike price), while the option seller is required to fulfil the obligation when the option buyer exercises the right in exchange for the premium from the buyer.

Understanding accumulators

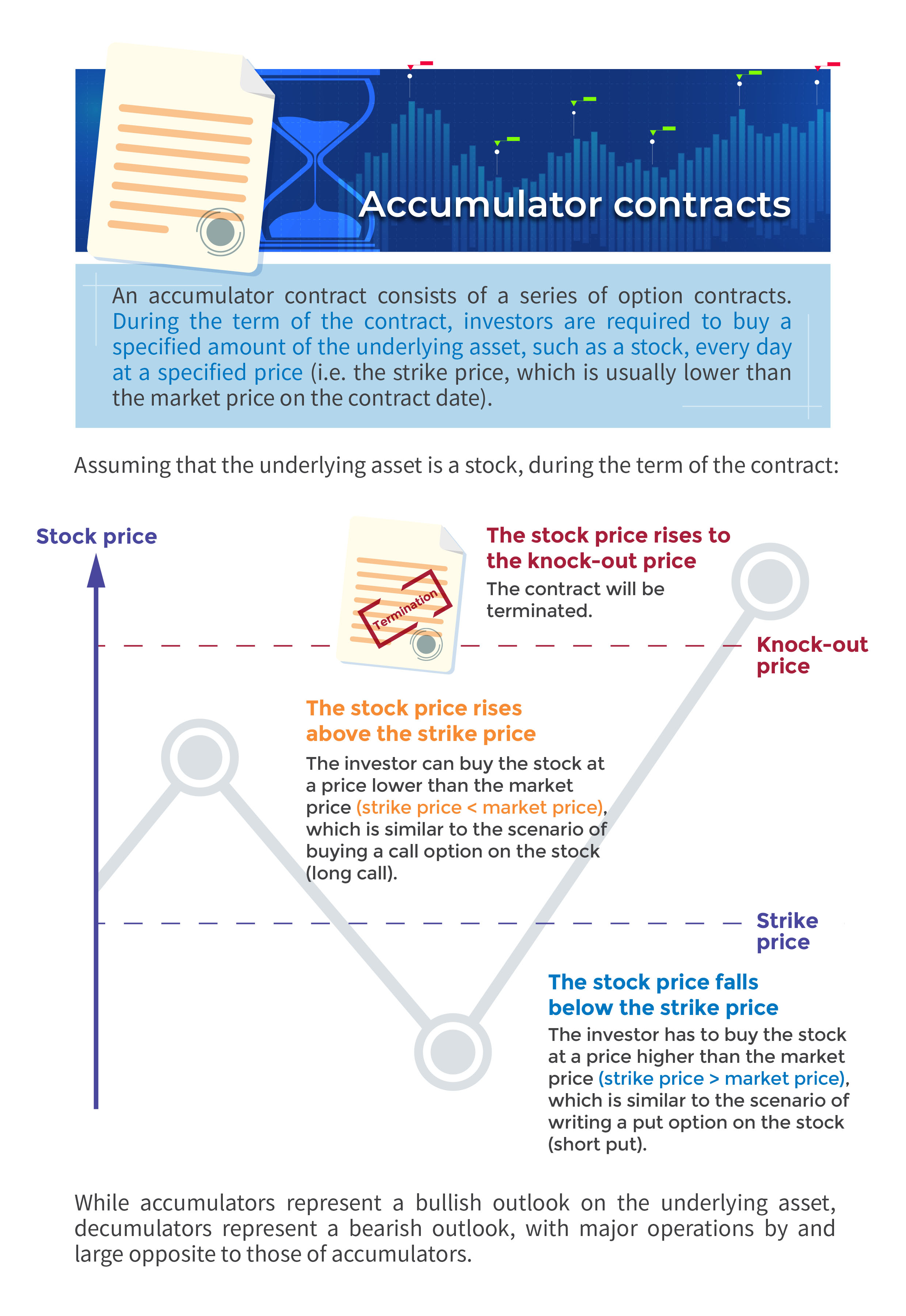

Accumulators are attractive to investors because the strike price is generally lower than the market price at the start of a contract, giving investors the opportunity to buy the underlying stock at a “discount”. However, such “discount” in fact comes from the premium the investors receive from writing the put option (short put).

Moreover, such contracts usually have a knock-out clause, whereby they will be terminated when the underlying stock price rises to the level of the knock-out price, and the investors will no longer be able to buy the stock at the strike price. Such knock-out clause caps investors’ profits, but there is no similar clause to limit investors’ losses. If the price of the underlying stock falls sharply, even to zero, the investors still have to buy a specified number of the stock at the strike price every day as long as the contract remains in force, possibly leading to substantial losses. Therefore, some people describe buying accumulator as “penny-wise, pound-foolish”.

Accumulators are much more complex in their design than options. Investors should fully understand the structure, operation and risks of these products and ensure that they have sufficient net worth to assume the risks and bear the potential losses before investing.